Description

A new business owner often begins by taking some of their personal funds, in addition to funds they borrow from a lending institution to provide their new business with the necessary fixtures, equipment, and inventory as well as provide the necessary capital to pay operating expense until the business is turn a profit.

While the funds from the lending institution will have a prescribed schedule for repayment, the funds that the business owner often do not. In reality, while the owner of the business may not have a schedule for the repayment of these funds, the owner should know what kind of return is being earned by the investment.

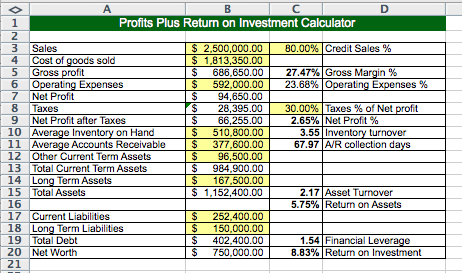

This calculator, provided by Tom Shay, requires information from the year end profit and loss statement, the balance sheet, and requires some calculation from the month end balance sheets. For the ‘average inventory on hand’ and the ‘average accounts receivable’ calculations you will need the appropriate number from each of the 12 month end balance sheets. Add the 12 numbers together and divide by 12 to obtain the average.

To learn the most from this exercise, we would suggest that after completing the chart with the actual numbers from your business, you would begin to change numbers to what you believe you can achieve and see what the return on investment percentage changes to. As you do so, you will learn how to make the investment in your business provide you with a bigger return.

Reviews

There are no reviews yet.